Buying Beaten Up Assets – Special Offer 50 Percent Off Regular Price Expires Friday!

- Apr 30, 2014

- 3 min read

Dear Subscriber,

Markets are approaching very important inflection points. When the S and P 500 hit a new high in early April this made this the second longest bull market going back to 1932.

WATCH THE VIDEO BELOW ON HOW TO USE MAXIMUM PESSIMISM :

Since 2008 the Federal Reserve has increased its balance sheet from just over $500 billion to over $4 trillion. Since November 2012 the Fed has printed over $1.4 trillion.

It seems that everyone is trying to rationalize this bull market. They want to believe a new boom is here.

The problem is the Federal Reserve is just trying to re inflate old bubbles. The Stock market, housing etc… They are using a form of trickle down economics that re creating the wealth effect through increasing asset will stimulate the economy that is not working.

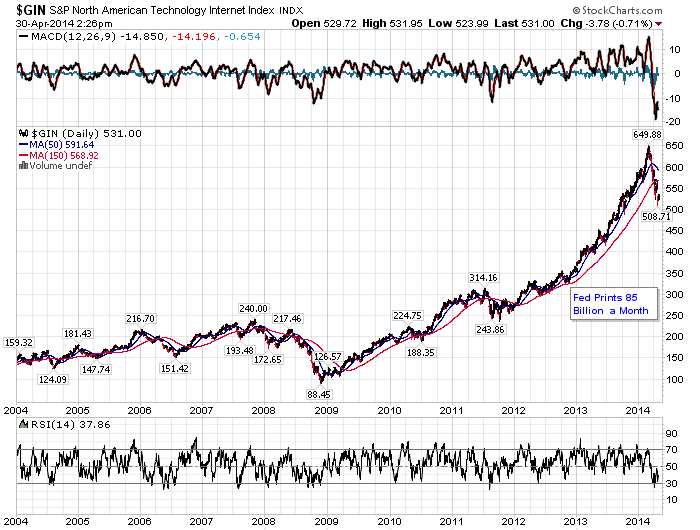

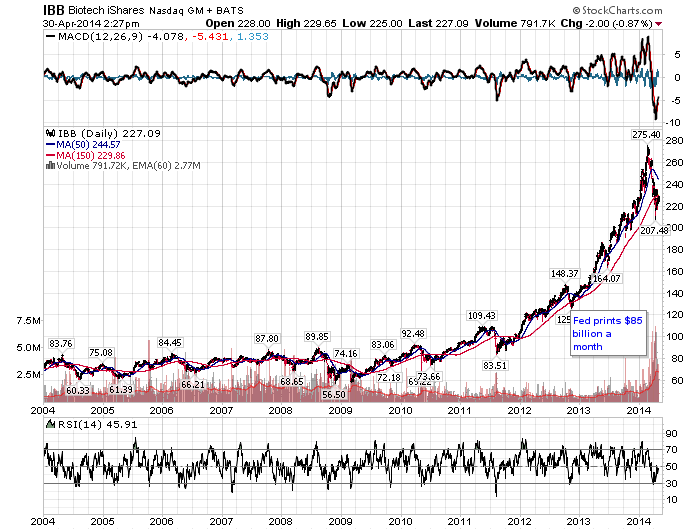

It has been successful in inflating the stock market. However, now we are entering dangerous times. The bull market is long by historical standards. The Federal Reserve is unwinding its QE program. I have enclosed a few charts of the bubbles the Fed has inflated. These being in Biotech and Internet and small cap stocks. Note in these charts I have marked where the fed started its 85 billion a month QE program. Note that the increases in markets coincided with this program. However, the fed is now tapering and these momentum stocks are starting to crack.

The only time in history we have seen a huge stimulus like this was in the thirties when Roosevelt expanded the federal government to stave off the great depression in 1937 he took away the stimulus and the market fell hard. In addition, in 2000 the same argument was made that while Tech was in a bubble much of the rest of the market was not. Just like now we saw some rotation into other sectors before tech forced the entire market down. Therefore, it is a time for caution.

We also take a look at the markets from a different perspective. We show you like unlike most of the financial media we are not obsessed with the performance of the S and P 500. You can be patient waiting for beat up sectors and stocks to become cheap. There are always sectors that are in free fall and are undervalued. For example, as you will see from the video we have enclosed if you are patient and wait for opportunities to arise you can outperform the market a great deal without having to take excessive risks.

Rather than chasing hot sectors you can buy cheap assets and not only that also get superior returns.

If you like our philosophy and our approach to markets we now have a special deal on to Addicted to Profits. Our regular price is $699 a year. For a limited time (until Friday) we have a special deal for $349 a year or 50 percent off the regular price.

Our service includes the following

1. 20 Bi Weekly issues a year covering Macro Market Trends and our analysis of markets 2. Weekly Email Updates 3. Weekly Podcast 4. Weekly Video Updates 5. Watch list of Recommended Companies updated every quarter

Why not try and subscriber today. Our unique approach can help you profit in both bull and bear markets and find undervalued stocks that others are ignoring. For less than $1 a day this service is more than worth your while. Please subscribe today this offer is only available for a limited time!

Sincerely,

David Skarica

Comments