Does 2014 Equal 1937??

- Apr 28, 2014

- 3 min read

Does 2014 Equal 1937 ?

I thought I share an article on some similarities between 1937 and today.

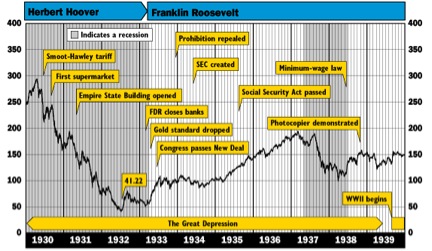

In 1929 the market had probably the most famous crash in its history and fell nearly 89 percent till its 1932 bottom.

When Roosevelt was elected he underwent some major changes to stimulate the economy. He closed bad banks, devalued the dollar and started a massive expansion of the federal government with government spending more than doubling from 1933 to 1936. The stock market soared from a low of 41.22 on the Dow in 1933 to nearly 200 in 1937. The problem was it was an artificial rally held up by government stimulus.

In 1937 when the stimulus was taken away the market began a huge drop falling from nearly 200 to under 100 by the spring of 1938.

Why is This Important?

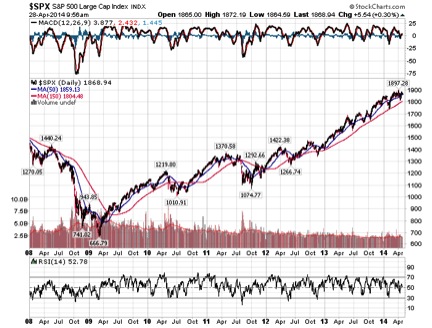

I think it is important because that market rally came out of a financial crisis and had government stimulus to keep it going. In 2008 and 2009 we had a bank bailout and fiscal stimulus.

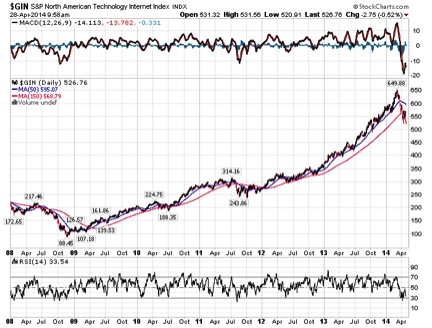

Since that time the Fed has increased its balance sheet by nearly $4 trillion. If you look at the markets you will see that ever since the Fed announced it would expand its QE program to $85 billion back in November 2012 you will see that is when the bubble sectors began their straight up ascent.

This like 1937 this has been a liquidity driven bull market driven by the authorities. Now just like 1937 the authorities are taking away the stimulus. The consensus seems to be that these momentum sectors can decline and the rest of the market will be fine.

However, we must remember that in 2000 when the Dot coms began to bust the rest of the market held up fine until the fall of 2000. However, as these were the leaders of the market and at some point they will take the market down with it.

Copyright © 2014 Addicted to Profits. Reproduction in whole or in part without permission is prohibited. All rights reserved. No part of this publication may be reproduced, stored in a special system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise without prior permission of the publisher.

This publication contains the opinions and ideas of its authors and editors and is designed to provide useful advice in regard to the subject matter covered. However, this publication is sold with the understanding that publishers, editors and authors are not engaged in rendering legal, accounting or other professional service. If legal advice or other expert assistance is required, the services of a competent professional person should be sought. Those involved in this publication specifically disclaim any responsibility for liability, loss or risk, personal or otherwise, that is incurred as a consequence, directly or indirectly, of the use and application of any of the contents of this publication.

Notwithstanding anything to the contrary set forth herein, this publication’s officers and employees, affiliates, successors and assigns shall not, directly or indirectly, be liable, in any way, to the reader or any other person for any reliance upon the information contained herein, or inaccuracies or errors in or omissions from the publication, including, but not limited to, financial or investment data.

Authors and contributors warrant that their contributions do not infringe any copyright, violate any property rights, or contain any scandalous, libelous, obscene or unlawful matter or any formula or instruction that may be inaccurate or may be injurious to the user.

Comments